In this section, we will explore and implement the trade finance use case. Let’s consider an international trade process. To carry out an international trade, several parties or organizations need to coordinate with each other. They typically include, but not limited to: buyer (importer), seller (exporter), banks, shipping and logistics firms, port and customs authorities. The international trade process of today is often time-consuming and ineffective due to several regulations and documentation at each stage of the process. This not only makes the trade process ineffective but also adds a huge burden of cost.

Secondly, there is lack of visibility around the entire process, and each party to the trade maintains their own truth of information. There is no shared consensus and often arise lack of trust especially if they have not conducted business with each other before.

As creating the entire trading process may not be pragmatic within the scope of the book, we will implement a very simple trade finance use case that will involve exporting goods from seller to buyer and cover the process of creating and authorizing LOC and shipment using Hyperledger Fabric blockchain technology.

“Trade finance refers to financing a trade. In simple terms, a trade is an exchange of goods and services between buyers and sellers or importer and exporter. Trade can be a domestic or international trade. Banks or financial institutions provide a different form of financing avenues to support a trade. Financing does not only involve lending money but also making sure appropriate documentation is carried out so that the trade process is efficient and parties to trade can do business with confidence and trust.”

We will introduce a fictitious company named Free Trade Enterprise (FTE) – providing a trade finance application to conduct free and fair trade, transparent to all the parties. The application will be implemented using Hyperledger Fabric blockchain platform. The application will enable parties to the business execute a trade in a secured fashion by means of consensus and provenance, so as to provide transparency and accountability thereby reducing the time of financial trade from days to hours.

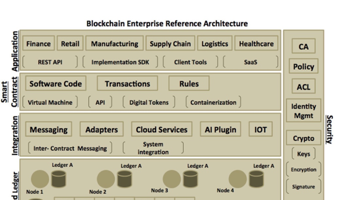

The FTE provides a marketplace model where trading can happen through shared consensus by the parties involved in the business. The marketplace uses many technologies apart from blockchain to make trading smooth and transparent. The technologies could include artificial Intelligence to match prospective sellers with buyers based on buyer’s requirements, rating, and past trades. For new buyers, recommendation systems could pick up best-rated and safe sellers and trusted associated parties and provide optimization of trade based on similar requirements.

Internet of Thing (IoT) technology can be used to automatically track goods and shipments at various intervals. For instance, goods that require to be transported over some optimum temperature, sensors can be employed that update contracts automatically if the temperature is dropped to a certain level. GPS coordinates can be tracked at various intervals to ensure real-time event tracking of trades.

As you see the possibilities are endless and one can leverage a combination of these technologies, backed by consensus through blockchain for next generation trade platform.

The users of our trade finance application are categorized into four distinct entities:

- Buyer (registered with FTE)

- Supplier (registered with FTE)

- Importer and exporter bank (part of larger Banking Consortium)

- Shipper (Shipment and Logistics firm)

The Trade scenario

A buyer (importer) registered with FTE wishes to buy 5 cartons of rich baked almonds with each carton containing 500 packs. FTE provides a Fabric blockchain platform where parties to the trade can create relevant documentation using smart contract. The buyer initiates the process by making a purchase inquiry to the seller. The seller views the purchase order and registers a sales order against it with certain terms and conditions about the sale. Once the sale contract is established, the importer bank will issue a letter of credit (LOC) to the exporter bank. This is one way of providing credit to the buyer on presentation of relevant documents, like bill of lading, by the seller. Once the exporter bank receives and validates the terms in the letter of credit, the seller approves the same, which initiates the shipment process. The shipping company will scan the goods and prepare the bill of lading (BOL) document, signifying the initiation of shipment process. Once the buyer receives the goods, it endorses the bill of lading document thereby indicating the completion of the trade.

In the above process, we are not dealing with any physical documents like purchase order, LOC or BOL but creating a smart contract and updating the status as the trade progresses. As we move towards a digital world, we envision a future where digital contracts would replace physical documentation as legitimate and legal artifacts.

We will implement the above flow using Hyperledger Fabric and start from the LOC creation process. We will assume that buyer and the seller have entered into an agreement to perform a trade involving the purchase of rich almonds. So, our smart contract is ready with purchase and sale order details.

Application Design and Implementation strategy

We aim to provide a universal design and implementation roadmap for a permissioned-based enterprise blockchain. The stated approach is generic in nature and will provide you with a fair idea on how to kick-start your blockchain implementation in the enterprise. We will start with identifying business entities and designing the network topology and end up showing implementation and deployment. In the end, we will demonstrate the end-to-end test cases that will fulfill our smart contract as it executes transactions and query through the same to depict the final trade completion state.

The approach will have the following stages that can be used to design and implement a permissioned enterprise blockchain application:

- Defining Business Network

- Designing Network Topology

- Defining Smart Contract

- Application Deployment

- ● End-to-end Test Execution

Defining Business Network

Defining business network involves identifying parties to the business, their roles, and stake in the business. It involves creating users, their roles and affiliations or departments. For our trade finance application, we will use three different groups of business entities that will form the business network to carry out the trade business. All these entities will interact with the trade finance application and perform its respective function to fulfill a smart contract to take it to its logical end. In short, it will signify the completion of the trade in a free, transparent and trusted manner. The following are the three entities or organizations we will configure:

- Free Trade Enterprise (FTE)

- Banking Consortium (BNK)

- Shipping and Logistics firm (SHP)

Free Trade Enterprise (FTE)

FTE will consist of registered buyers and sellers that make use of the platform to discover each other and carry out trades. Their goal will be to fulfill their purchase and sale orders respectively. They will interact with the application to typically initiate the quotations or proposal and approve them as smart contracts. The following table depicts the user organization of FTE:

| User Id | Role | Organization MSP Id |

| User1 | Buyer | Org1FTE |

| User2 | Seller | Org1FTE |

As shown in the above table, we have two users defined with the roles of buyer and seller respectively and an MSP id of the organization to which the user belongs. (Note: MSP Id can be any arbitrary value; it just identifies your organization). In Hyperledger Fabric, the users can be created using Fabric CA client component. But one can also plug in their own CA server implementation to create users or generate crypto credentials. For our trade finance application, we have used the cryptogen tool provided by Fabric runtime, to generate users and certificates. This is discussed in the later section.

Banking Consortium (BNK)

The banking consortium can be viewed as a consortium of various banks. For our trade finance application, we will have an importer and an exporter bank as a member of this consortium. Importer bank will be involved in the process of LOC creation, which will be eventually approved by the exporter bank. This will be all done using trade finance application provided by FTE through the use of smart contracts. Just like FTE, the banking consortium will also represent an MSP. The below table depicts its user organization:

| User Id | Role | Organization MSP Id |

| User1 | Importer Bank | Org2BNK |

| User2 | Exporter Bank | Org2BNK |

We will have users with the role of importer and exporter bank respectively. The MSP id of the consortium will be Org2BNK

Shipping and Logistics firm (SHP)

Our design will have a separate entity that will handle shipping and logistics aspect of the trade. Once the seller verifies the LOC approval, the shipper will initiate the shipping by creating the BOL document. This again will be done using the smart contract. The below table depicts the user organization of the shipper:

| User Id | Role | Organization MSP Id |

| User1 | Shipper | Org3SHP |

There will be only one user with the role name as a shipper and the MSP id as Org3SHP

In the next stage of our design and implementation approach, we will talk about designing a network topology.

Designing Network Topology

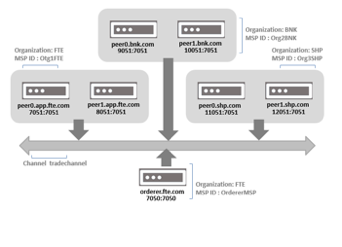

Designing a network topology is a very significant step when it comes to implementing blockchain in the enterprise. For our trade finance application, the network topology or the deployment model will look like the following:

The above network topology defines a blueprint with many nodes or deployment units that communicate with each other to execute or fulfill a blockchain transaction. Our network design will comprise of six peer nodes representing three different organizations viz. FTE, BNK and SHP and an Orderer node. The model also depicts a channel that will be used by peers to validate and execute transactions.

The Orderer node will be responsible for guaranteeing transaction order and delivery. The orderer service is also used to create a channel that provides a common communication infrastructure for peer and client nodes. Our orderer node will be part of FTE organization (orderer.fte.com) hosted on port 7050. The orderer service is bootstrapped with genesis block also known as the first block of the blockchain network that contains configuration details like which organization will manage the orderer node and number of peers and users managed by each organization.

Channel is another core component that provides a common infrastructure for all the peers (part of that channel) to communicate. We will have one channel termed as ‘tradechannel’ where our MSP instances like orderer (orderer.fte.com) and peers from all the three organizations will participate in the transaction. Each peer will have its own copy of ledger associated with ‘tradechannel’ channel. In short, all the peers will have visibility of every trade finance transactions that will be carried out on this channel.

Every organization will host peer nodes. We will have two peers per each organization – peer0.app.fte.com and peer1.app.fte.com as part of FTE, peer0.bnk.com, and peer1.bnk.com as part of BNK and peer0.shp.com and peer1.shp.com as part of organization SHP. One of the responsibilities of peer is to execute the transactions and validate them against the endorsement policy. The transactions itself will be part of chaincode that represents our smart contract. And therefore, our chaincode named ‘tradefinancecc’ will be installed on each peer. Peers itself can also become an endorser of transactions. All the peers will form a part of channel ‘tradechannel’.

In the next article, we will talk a bit about our trade finance smart contract, termed as ‘tradefinancecc’. We will explore through the business methods and workflow that will represent the trade finance application.